Financial Planning, Must Have Documents · January 15, 2026

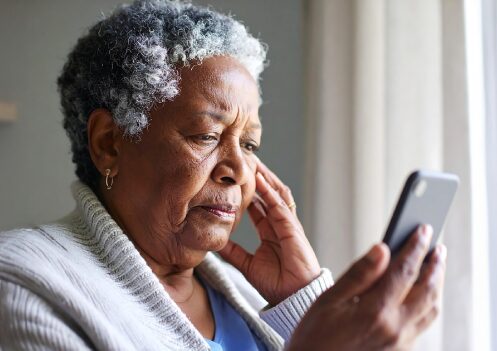

How to Make a Family Financial Fraud Plan

Older adults have become a favorite target for financial scammers. The Federal Trade Commission recently reported that adults at least 60 years old reported losing $2.4 billion to scammers in 2024. And that’s just people who knew—and took the time—…