Personal Growth

Boosting Your Work Skills

There’s never a bad time to add to your work skills. But right now seems like an especially important time to consider ways to make sure you remain a valued employee.

Worried About Job Security?

No matter how successful you have been in your work life, as you age there can be a gnawing worry that your skills may not be as up to date as younger workers in your field, or in your own office.

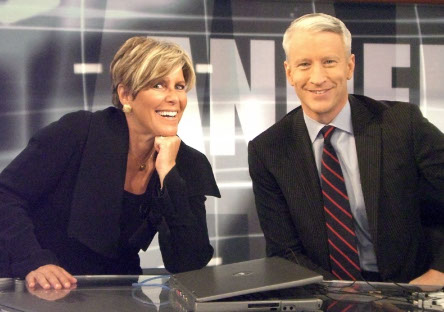

Podcast Episode - Suze Orman’s 2025 Suze School Commencement Address (and more)

Since we’re in Graduation season, today’s Suze School starts with a commencement address from Suze to all of you! Then, Suze briefly recaps what happened in the economy during the month of May. She

Podcast Episode - Suze School: What’s Your Emotional Money Score?

How many times have we heard Suze say that the internal obstacles to wealth are fear, shame and anger? For this Suze School, we’re going to find out exactly what our emotional money score really is.

Podcast Episode - Suze School: The Six Secrets to Suze’s Success

For almost 25 years, KT has listened as Suze imparted great wisdom. On this episode, KT is highlighting six "Suzeisms" and Suze explains why these rules to live by will help you be successful in

Building Community Around Women and Money

If you are reading this I know you are someone who is motivated to make smart decisions that will build financial security.

Give Yourself This Gift

I hope your holiday season is full of love, fun, and deliciousness. And that you didn’t exhaust yourself, physically and financially, with gift-giving.

Podcast Episode - Suze School: Serious Things To Think About

Suze starts by asking us to think about the power of our words, specifically “can” and “can’t.” Then, Suze tells us what we need to think about, with regards to Social Security and how we can best

Podcast Episode - Suze School: Let Go

Do you hold onto things, even when they are not working out for you? Maybe you’re holding onto clothes or belongings that you don’t need. Maybe you’re holding on to a relationship that is not goo

Get Back on Track With Your Financial Resolutions

It’s that time of year again, my friends. Right about now is when so many of us have lost the resolve and momentum to stick with a financial goal we made part of our New Year’s resolutions.

How to Help Your Kids Without Hurting Yourself Financially

According to a new survey from the Pew Research Center, many young adults are still reliant on a parent for financial help. Just 45% of young adults between the ages of 18-34 say they are complete

The Best 2024 Financial Resolutions

I hope you are ending this year in stronger financial shape than you began. And it is my wish for each of you that 2024 is a year of building more financial security.

Podcast Episode - Suze School: What Is The Biggest Mistake One Can Make With Their Money?

In this Suze School episode, Suze teaches a very important lesson on how to avoid making the biggest mistake you can make in your financial life. Think about the things you take for granted, think ab

Podcast Episode - Suze Goes To School and Highlights from The Six Most Valuable Words In Life

This week while Suze is in school herself, we present highlights of an episode called “The Six Most Valuable Words in Life.” This was originally published on March 17, 2019.

Retirement Rule Changes for 2023

Congress recently passed a bunch of new rules that will impact how much you can save for retirement, make it easier to save in Roth accounts, and change when retirees must start taking withdrawals fro

Podcast Episode - Ask Suze & KT Anything: Worried About Taxes and FICO Scores

On this episode of Ask Suze & KT Anything, Suze answers questions about dollar cost averaging, schemes to pay less tax, reducing volatility in investments, staying budget friendly when starting a busi

Podcast Episode - Live A Life You Love

On the day of the Super Bowl, Suze talks about the importance of rising above your own limitations and living a life you love. Plus, it’s time for a new theme song.

Investing in Yourself

Okay, now that the headline got you to keep reading, I want to be clear that there will be no financial advice forthcoming from me. I want to talk to you about something I believe is more important.

Podcast Episode - Don't Rush Time

On this podcast, Suze talks about why it is important to be patient in all aspects of our lives. Remember, time does heal all wounds and time helps your money grow for the long run.

Don’t You Dare Give Up on Your Resolutions

February is a rough month for good intentions. Surveys show that this is the month when many of us lose the momentum to stick to our New Year’s resolutions.

A New Year Begins

A new year begins. May it bring you and your loved ones new bursts of happiness. And health. That is all that matters. Right?

Truth and Consequences

I'm back! And I have to tell you, I've learned a lot these past six weeks. I've learned a lot about me and I've learned a lot about how I was making the mistake that I often tell all of you not to mak

3 Signs Your Generosity is Costing You Way Too Much

One of the most harmful blind spots women have is a tendency to be too generous.

The Most Overlooked Financial Tip

For all the time and effort and worry we put into our financial health, we often overlook how our emotional and physical health interacts with our financial security.

Podcast Episode - The Emotions of Money

In this podcast, Suze explains why we should not let our emotions rule our ability to make smart choices with our money.

Podcast Episode - Honesty, Transparency And Respect

In today’s podcast, Suze shares stories meant to teach and inspire us all to rise above, from Women & Money listeners Kay and Terry.

Podcast Episode - Clearing The Funnel of Fear

In this podcast, Suze shares a story about how she was recently afraid to do something and how she overcame her fear. Remember, when you have a fear of something, that fear blocks everything.

Podcast Episode - Where Is My Mentor

In this podcast, Suze responds to an email from Women & Money listener, “M,” who appears to have everything going the right way in her life and yet she still feels lost.

Podcast Episode - Ask Suze Anything

Suze shakes things up a little bit on this podcast of Ask Suze Anything. Today, she shares four emails from Women and Money listeners that she found profound.

Podcast Episode - Confidence In Belonging

Belonging and being accepted is a key to financial success. Just back from a trip to Washington, D.C. Suze talks about belonging and how in order to be successful, you have to be proud of who you are.

Podcast Episode - The Great Destructor Of All

What is the great destructor of all? In this podcast, Suze gives us an update on the help she’s been offering Women & Money listeners A.T. and Brenda, to get out of their abusive relationships.

Podcast Episode - The Money Mind

In this podcast, Suze talks about the “money mind.” What are the three simple steps you need to do in order to live within your means?

Podcast Episode - There Is No Shame or Blame Big Enough

There is no shame or blame big enough to keep you from being who you are meant to be. Very powerful words, and in this episode of Women and Money, Suze talks about how you can start over after bei

Podcast Episode - Are You A Rabbit?

For this Easter 2019 episode of the podcast, Suze shares a great story of how distractions pull you away from your goals and how you may be a distraction to others.

Podcast Episode - What Does Self Worth and Twitter Have In Common?

In this episode, Suze reads a very moving story about a woman who was in an abusive relationship and did not realize it.

The Financial Upside of Decluttering

Marie Kondo’s Tidying Up series was a popular choice on Netflix in January. It seemed to inspire so many people to get more serious about de-cluttering their homes.

Women & Money: Are You Truly Financially Empowered?

A year ago, I had the honor of speaking to a large gathering of seriously successful professional women. I enjoy every opportunity to meet with women, field their questions, and hear their stories

**SOLD OUT** See Suze LIVE at the APOLLO!

**SOLD OUT**The time has never been more right for women to finally take control of their finances.

Vacations are an Important Career Move

According to a national survey, more than half of Americans don’t use all their vacation days. I think that’s a bad career move. Vacations aren’t an indulgence, they are a necessity.

You Can’t Afford to Stay in a Job You Dislike

Given the looooong hours I know you put into your work, it seems obvious that you should get plenty of satisfaction from all that work. Yet according to Gallup less than one-third of workers are “involved in, enthusiastic about and committed to their work and workplace.”

Can You Pass My Financial Strength Test?

A recent Gallup poll found that Americans are the most positive about their financial situation in a long time. Fifty two percent reported that they feel good about their finances. That’s a big jump from the 41 percent who felt the same five years ago.

The Big Mistake Half of Workers Make

A recent survey reports that 52% of workers who were eligible for paid vacation last year, didn’t use all their available time off.

What to Do With an Unused Gift Card

I hope your friends and family hit the bull’s eye with your gifts this holiday season. But I bet there are many of you who received a gift card (or two, or three) that you don’t have a burning desire to use. As much as you love the sentiment of the gift giver, perhaps you just don’t need-or want-anything from the particular retailer your gift-giver chose.

Financial Resolutions for 2017? Just Do This One Thing

If you have been making a long list of resolutions for the New Year, my advice is to rip it up.

Leaving a Job? Don’t Make These 4 Huge Mistakes.

If you have recently moved to a new job, or one of your 2017 resolutions is to make a move, I want you to be super smart with how you handle your retirement savings account you built at your old job.

Give Your Kids the Gift of Giving

The run up to the holidays at the end of the month is an especially great time to teach young children some money and life lessons.

My Holiday Challenge: How Much Can You Save While Shopping?

You know that I have often stated that one of the keys to financial freedom is to feel as much pleasure from saving, as you get from spending.

The Stealth Retirement Move That Can Save You a Bundle

When it comes to planning for a secure retirement I bet you have the major strategies covered: -Invest in your 401(k) or 403(b) up to point of the match? Check -Save in a Roth IRA? Check -Aim to have your mortgage paid off before you retire? Check -Commit to getting plenty of exercise?

Teach your Children Well-Part 3: Give Your Kid’s Credit

Young adults are making a big mistake with their finances. Survey after survey reports that most millennials do not have a credit card. I am wholeheartedly on board with preferring a debit card. But everyone needs to also have a credit card and use it responsibly.

Suze’s Mortgage Tip #1: Shop Around

It amazes me that so many homebuyers who spent weeks, if not months, hunting around for the best home, don’t shop around as diligently for the best mortgage. According to the Consumer Financial

Are You Fluent in the Language of Wealth?

I spend a lot of time helping people work out a plan for overcoming a financial challenge. Quite often the bulk of my work is in getting them into the right frame of mind. Financial problems are so stressful it is completely reasonable to feel anxious or depressed. But the first step in working your way out of a financial fix is to convince yourself you control your future and you have the ability to make it a great future.

Are You Making This Dangerous Retirement Planning Mistake?

I am concerned that many of you are banking on a retirement strategy that may not work out. According to a national survey, more than four in 10 Americans say they plan to keep working past the age of 65.

The Most Important Tax Tip: File ASAP!

I know you probably can compile a very long list of things you’d rather do than tackle your 2015 tax returns. But please listen to me: procrastination could cost you big time this year, if you anticipate you will be receiving a refund.

Conquer Your Fear of Debt: 3 Crucial Steps

When it comes to financial fears, debt is the ultimate four letter word. Whether you have credit card debt, or student loan debt, or want to buy a home or a car that you will finance, you’re dealing with debt. Or more to the point, it’s probably throwing you for a loop. Debt is the major stress point in every household that I’ve worked with.

Conquer Your Retirement Fears

I don’t know about you, but if I see or hear of one more survey about how panicked most Americans are about their retirement, I will scream. That we have a national fear of retirement preparedness is abundantly clear. What we need now are less surveys and more advice on how to conquer retirement fears. Here are my key steps to start down your road to retirement financial freedom.

Financial Fear No More! Three Steps Toward Financial Freedom

Your money challenges are very personal. You may have a large credit card balance gnawing at you, while your best friend is awake at night worrying about being able to keep working through her 60s,

16 Wishes for 2016

As we turn the corner into a new year, my biggest hope is that peace and happiness is in great abundance for each and every one of you and all those you love. You know from years of hearing me invoke “People First, Then Money, Then Things” that I think there should be no bigger focus than building and nurturing that peace and happiness. But there is also always room to focus on the ways you can continue to build financial security in 2016. The progress you make on taking control of your money will, after all, bring even more happiness and peace into your life.

Health Insurance: 3 Reasons You Should Pick the HSA Option

About half of large employers now offer a high-deductible health insurance plan (HDHP). I know the mere mention of “high deductible” might send your blood pressure skyward, but please listen to me. For many of you, a HDHP may be the smartest health insurance.

Emergency Fund 101 - How Much Should You Have Saved?

It makes me so sad to read reports that many households don’t have even $1,000 set aside to cover an unexpected expense. What’s so sad is that I know that must cause such stress.

Three Steps to Guaranteed Financial Independence

As a nation we set aside one day a year to formally celebrate our independence. When it comes to your money my hope is that you will make every day, not just July 4th, a day where you make conscious decisions that will help you build financial independence: a life where you are in control of your money, and not vice-versa.

Long-Term Care Insurance Update

I have said over and over again that as you enter your late 40's to 50's you should look into buying long-term care insurance. But looking and buying are two different things. You should only purchase LTC insurance if you know that you can easily afford the premium at the time of purchase and all the way until you are 81 (which is the average age of needing LTC).

The Two Biggest Mistakes You Can Make When Buying a Car

If you lack the cash to buy a car free and clear, you really need to hear me out on the two worst financing moves you can make. What I am about to tell you can save you hundreds, if not thousands of dollars. And trust me, this is exactly what car dealers and financing companies don’t want you to know:

Suze Orman’s 10 Tips To Spring Clean Your Finances

Spring is in the air! Springtime is about renewal and rebirth, and therefore a perfect to take stock of your life, and take charge of your finances. It’s time to get off the fence and spring clean your finances, ladies!

Same-Sex Marriage Ban Ends in Florida

Last night KT and I were lucky enough to get to go to the courthouse in Del Ray Fla to participate in the first gay marriage ceremonies. Read my thoughts on this historic day.

Suze Orman’s Practical Real-Estate Portfolio

The personal finance expert’s holdings are in places like New York, the Bahamas and South Africa

Attention Student Loan Borrowers: Can You Pass my Repayment Test?

I fear many student loan borrowers are flunking out when it comes to choosing the right repayment plan. Here’s a quick quiz to test your repayment smarts:

The Road Not Taken: How Losing $50,000 Became My Biggest Gain

Far from aspirations that would lead a reporter to refer to me as “a force in personal finance,” my career is the result of a hot tub dream gone bad.

Let’s Not Sell Young Retirement Savers Short

A recent paper from the influential Research Affiliates investment management firm (more than $140 billion in assets managed) takes the provocative stance that young adults saving for

What Baby Boomers Are Getting So Wrong About Retirement

Listen up my 60 something friends (and those of you heading to that milestone soon) we need to have a talk about your retirement planning.

Karma Is Not A Negotiating Tool

I am a big believer in karma. But to suggest that good karma should be the lynchpin of managing your career is not just wrong, but dangerous.

Suze Orman’s Dos and Don’ts during government turmoil

Congress’ shenanigans to shut down the government for 16 days this month has many Americans rightfully concerned about their personal finances.“If you don’t want to be affected by the actions—or lack of actions—in Washington, you and you alone are going to have to save yourself,” insists Suze Orman.

The good thing about bankruptcy

Bankruptcy rates spiked during the 2008 recession and many were pretty judgmental toward the millions who couldn't afford to pay their bills. But Suze Orman says bankruptcy is the better option over burying your head in the sand. "When somebody really doesn't have money to pay their bills then they should claim bankruptcy and face it right on and start all over again," says Orman.

Resist home-buying pressure, Suze Orman advises

The recent rise in housing prices and the decrease in supply in certain parts of the country have some people willing to spend every nickel they have to get into the market now. But Suze Orman warns hopeful homebuyers not to be hasty and end up house poor.

Suze Goes Back To School!

Sundance Channel announced an impressive list of innovators and leaders from a cross section of professions including music, politics, film, science, journalism and more who will come together to

Smooth Sailing With Suze Orman

America's most famous expert on personal finance and star of her own award-winning CNBC television show offers advice for “staying” afloat in these economically turbulent times, thanks to lessons learned at sea.

A Must-Read Letter

“Hello Peach, Well much has gone on since we last chatted. Are you ready, better take a deep breath...”

Noted Financial Adviser Suze Orman To Speak At Vet School Commencement

Personal finance guru Suze Orman has a message for college students debating whether to take out thousands of dollars in student loan debt to get a master's degree or professional degree: Make sure

The 8 Qualities of a Successful Life

Years ago, after my first book came out and I had made a few television appearances, I was nearly accosted on the street by a very animated woman who kept pointing at me and then exclaimed "I know who you are... you are the... Money Lady!" I've adopted that as a nickname of sorts. I am indeed the lady whose passion is to help people make the most of their money.

The Three Communication Skills That Make Suze Orman An Influential Celebrity

More than 300,000 financial advisors in the United States provide saving, investing and retirement advice, but only one made the top ten of the Forbes 2013 list of the most influential celebrities: Suze Orman.

Suze Orman Now Available on the CNBC Alarm Clock App

The CNBC Alarm Clock App has added the voice of Suze Orman, host of CNBC's "The Suze Orman Show" (Saturday nights at 9PM & 12AM ET), by popular demand. Now CNBC Alarm Clock users can select the award-winning television host to get them up and make sure they get right to business.

Gay Americans pay more taxes for fewer rights

That nine states and the District of Columbia have legalized same-sex marriage is encouraging progress for those of us who believe that everyone deserves to have basic civil rights. But, even if every state in the country could pass a similar legislation, it would not be enough.

Changing Lives One Wallet at a Time

Letter From Wynne Sandra Korr, Dean and Professor at the School of Social Work, University of Illinois at Urbana-Champaign. Thanks to the

2012 Financial Awareness Video Festival

Suze and Cory Booker, Mayor of Newark, will be judging the final winner of the 2012 Financial Awareness Video Festival. Help us narrow down 10 finalists by taking a moment to view and vote for your favorite video!

Suze Video Interview Marlo Thomas

Marlo: “This week, I was joined by personal finance expert Suze Orman who is a veteran on Mondays With Marlo! Suze is so knowledgeable -- we spoke about everything from maximizing the value of your

Suze Orman Sits Down With Television Academy Foundation’s Archive of American Television

The career of Suze Orman was recently celebrated with a special three-hour interview with the Television Academy Foundation’s Archive of American Television

The “Influentials” Who Help Us Save Money

On Wall Street, in Washington and beyond, these folks have a huge impact on our daily lives and futures.