Women And Money

Podcast Episode - Take The Courage Challenge

Today’s Suze School challenges you to break the habit of financial fear. Suze explains how even making one small positive change can build up your confidence and help you realize your own power.

Podcast Episode - Friendship Isn't A Financial Plan

This Suze School episode is packed with three very important lessons, starting with why one of the biggest mistakes you can make is basing financial decisions on friendship. Then, Suze explains the c

Building Community Around Women and Money

If you are reading this I know you are someone who is motivated to make smart decisions that will build financial security.

Podcast Episode - Make Your Money Make More Money

For this Suze School, Suze gives us some updates on a few things, plus her projections on the stock market, bonds, real estate as well as the theme for 2025: "Make your money make more money."

Give Yourself This Gift

I hope your holiday season is full of love, fun, and deliciousness. And that you didn’t exhaust yourself, physically and financially, with gift-giving.

Podcast Episode - Suze Story: Are You Using Your Voice?

Suze talks about why she started focusing on the subject of “Women and Money” and why it is so important, especially right now, to use your voice and vote.

A Big Risk for Many Married Couples

The calendar tells me it is 2024, but I sometimes wonder if in some ways we’re stuck in 1964.

Podcast Episode - You Are the Ultimate Mother of Your Own Existence

In this special Mother’s Day episode, Suze recalls an interesting dream she had about her mom. She explains that today is a day to be filled with love, forgiveness and gratitude and for women why

Podcast Episode - Suze School: What Are You Capable Of?

What excuse keeps you from doing that which you are capable of doing? In this episode, Suze shares a lesson she learned about how silent negative thoughts were limiting her capabilities and how she ov

Podcast Episode - Ask Suze Anything: Where Does It Really Begin

For this episode of Ask Suze Anything, Suze takes on the role of reading the questions and answering them. She’ll help one listener determine if she’s being taken advantage of and then share a heartwa

Podcast Episode - Ask Suze & KT Anything: The Possibilities and Probabilities of Life

For this Ask Suze and KT Anything episode, we’re doing something different: KT and Suze are talking about some of the comments you’ve sent in regarding recent podcasts and how they helped you.

Podcast Episode - Highlights from: Don’t Turn Your Back on Yourself

Today, we're re-visiting part of an episode where Suze discusses why our negative thoughts, fears and actions limit our potential and prevent us from being safe, strong and secure.

How to Negotiate Your Salary

If you have a recent college grad in the process of looking for their first full-time job, I want you to encourage them to negotiate their salary.

How to Navigate Imbalances at Home

Over the past four or so decades we have seen a huge increase in the number of women working in paying jobs outside the home.

Podcast Episode - Ask Suze & KT Anything: All About Retirement Accounts

On this episode of Ask Suze & KT Anything, Suze answers your questions about rolling pensions into Roths, rolling 403(B)s into Roths, matching funds, investing in AI and more!

Podcast Episode - Suze’s Birthday Wish

Today’s podcast is a little different. Suze starts out reflecting about her 71st birthday and an important message about parents.

Podcast Episode - Ask Suze & KT Anything: Help! I Left My Job.

On this edition of Ask Suze & KT Anything, Suze answers questions about trusts, non-working spousal IRAs, medical deductions, unused credit cards, being a trader and so much more!

Podcast Episode - Suze School: Series I Bonds Master Class

For years, Suze has been telling us what a great investment Series I Bonds are. On today’s podcast, we get a master class detailing everything we need to know about these bonds.

Suze School: The Key To Your Financial Security

In this episode, Suze talks about an email she received from a listener who was convinced to invest in an insurance policy.

Are you copping out on this crucial skill?

A recent survey reports that more than 1 in 5 women who are in a committed relationship say they have little or no role in retirement or long-term planning.

Podcast Episode - The Pride of Self

As we start Pride Month, 2021 and celebrate Suze's 70th Birthday, she shares why it’s so important to have pride in yourself and again, why standing in your truth will make you stronger.

Podcast Episode - Mother's Day 2021

For our annual Mother’s Day podcast, Suze and KT revisits a podcast episode from May 12, 2019 where Suze shared a very personal letter she wrote to her mother.

Podcast Episode - Ask Suze (and KT) Anything

On this podcast of Ask Suze (and KT) Anything, Suze answers questions from Women & Money listeners Anthony, Nancy, Nina, Beth, Jasmine, Gayle, Shirley, Dan & Diane, Monica and Emily, read by KT.

Podcast Episode - Ask Suze (and KT) Anything

On this podcast of Ask Suze (and KT) Anything, Suze answers questions from Women & Money listeners Cindy, Anonymous, Chris, Name Withheld, Antoinetta, and Tom selected and read by KT.

Podcast Episode - Make The Right Choice

On this podcast, Suze talks about why making the right choices with your money will help you be safe and secure, especially in these uncertain times.

Podcast Episode - United We Stand

In this podcast, Suze talks about how we should be united with all aspects of our lives. Are we united with our money, our health and with the people with whom we’re in relationships?

Podcast Episode - Special Best Of: The Richest Advice Ever

In this podcast, Suze shares with you the book that set her on the path to financial freedom.

Podcast Episode - The Four C's Of Leadership

On this podcast, Suze shares a personal story about one of her dear friends. She also tells us the four key things we need to remember, in order to be successful leaders in our own lives.

Podcast Episode - The World Turned Upside Down

On this podcast, Suze reflects on the life of Ruth Bader Ginsburg and how our world has turned upside down. What can we do to make sure we’re strong emotionally and financially?

Podcast Episode - Truth Or Consequences

In this podcast, Suze shares with us why she needed to have surgery and the consequences of what happened when she didn’t stand in her truth with her health. You’ll hear a very powerful story.

3 Signs Your Generosity is Costing You Way Too Much

One of the most harmful blind spots women have is a tendency to be too generous.

Podcast Episode - Best Of: Changing The World, One Woman At A Time

On this podcast of Women & Money, Suze shares an email from podcast listener Natalie, who describes her heartbreaking experience with financial abuse.

Podcast Episode - Best Of: Trust Your Gut

While Suze is recovering from her surgery, Sarah and Robert present a "Best Of" episode from March 3, 2019. They read some well wishes from the Women & Money Community and give some insight.

Let’s Talk About Women and Money

With International Women’s Day coming up this week, I wanted to dedicate today’s newsletter to shed light on the topic of women and money.

Podcast Episode - Ask Suze Anything

In this podcast of Ask Suze Anything, we hear questions from Women & Money listeners Diane, Anthony, Lune, Christina, Allie, Julie, Roseline, and Shelia.

Podcast Episode - Survivors of Financial Abuse: A Conversation With Vicky May

The Women and Money Podcast is shining the light on financial abuse. In 2018, The National Domestic Abuse Hotline teamed up with Avon and asked Suze to speak with several survivors.

Podcast Episode - Words Of Wealth

True words of wealth are honest words. Suze explains why, by sharing an email from a Women & Money listener who at 46 years old has started to save for retirement, has debt and started a business.

Podcast Episode - The Great Destructor Of All

What is the great destructor of all? In this podcast, Suze gives us an update on the help she’s been offering Women & Money listeners A.T. and Brenda, to get out of their abusive relationships.

Learn from Your Daughters, Nieces and Granddaughters About Gaining Confidence Over Money

A recent survey by Allianz Life Insurance reports that nearly 6 in 10 women wish they were more confident in their money decisions.

Podcast Episode - The Five Laws of Life (Money)

In this episode of the Women & Money podcast, Suze explains how anger is part of what holds us back in life and of course, financially.

Podcast Episode - Ask Suze Anything: July 18, 2019

In this episode of Ask Suze Anything, Suze answers questions from Women & Money listeners Katie, Toni, Rose, Donna, Terry, and Edie.

Podcast Episode - Suze School: Investing for Retirement

In this episode, Suze School is in session and the lesson plan includes what you need to know about planning for retirement.

Podcast Episode - Ask Suze Anything: July 11, 2019

Suze Orman’s Women & Money Podcast

Podcast Episode - Ask Suze Anything: July 4, 2019

In this special July 4th episode of Ask Suze Anything, Suze answers questions from Women & Money (and the men smart enough to pay attention) listeners Joe, Kathy, Gina, and Danielle.

My Mother’s Day Wish

I want to wish all of the mommas out there a happy Mother’s Day.

Podcast Episode - Are You A Rabbit?

For this Easter 2019 episode of the podcast, Suze shares a great story of how distractions pull you away from your goals and how you may be a distraction to others.

Podcast Episode - Ask Suze Anything: Questions From The Apollo

For today’s Ask Suze Anything, we present the question and answer part of Suze’s appearance at the legendary Apollo Theater in Harlem, NY, as part of the Women of The World Festival on March 16, 2019.

The Most Important Personal Account You Must Have

There is new research that says couples that only have a joint bank account are happier than couples that keep some, or all of their money separate.

How Much Do You Know About Money? Tune in to Pickler & Ben to Find Out!

Suze On Pickler & Ben Monday November 5th

Life insurance made easy. (Promise!)

I have had such a great time sharing my newly revised Women & Money with so many of you over the past few weeks. As always, my favorite part of being out on the road is not the talking…but the lis

Why Every Woman Needs to Stop Relying on Men for Money Advice

For all of you who are happily married, or in a committed relationship with a man, I have two thoughts:

This One Move Will Automatically Improve Your Financial Life

This One Move Will Automatically Improve Your Financial Life

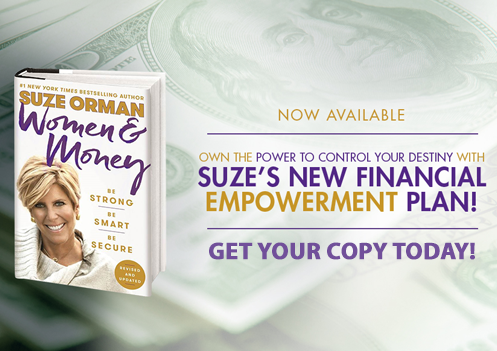

Get my Book Women & Money - Be Strong, Be Smart, Be Secure

Achieve financial peace of mind with the million-copy #1 New York Times bestseller, now revised and updated for 2018, featuring an entirely new Financial Empowerment Plan and a bonus chapter on invest

Women & Money: Are You Truly Financially Empowered?

A year ago, I had the honor of speaking to a large gathering of seriously successful professional women. I enjoy every opportunity to meet with women, field their questions, and hear their stories

Is Your Advisor Really Looking Out for You?

I have always said that if you are looking for the best financial advisor, just look into the mirror. You have everything it takes to manage your financial life, and there is no one more motivated

The Important Lessons Your Kids Won’t Learn in School

As a new academic year begins, I want to make sure that parents understand the important lessons that will not be taught in school.

Get Paid More to Save Safely

You know I am all for investing money you won’t need for decades in low-cost stock index mutual funds or exchange-traded funds.

Don't Miss Suze's Special on OWN October 1st @8pm ET

Suze kicks off October with her all new Women & Money Special on OWN

Could the One-Roof Solution Help Your Family’s Finances?

Financial stress is a multigenerational issue. Young adults look at high home prices in many parts of the country and wonder when –or if– they will ever be able to afford to buy.

Listen to My Women & Money Podcast NOW

It’s time all women find their financial voice. Listen Now!

Are You Falling into this Workplace Trap?

An updated version of my book Women & Money will be published next month. Why return to the topic?

A Late-Life Shock Women Can Avoid with Planning

A recent survey of more than 250 widows with a net worth of at least $1 million highlights how so many women set themselves up for later-life anxiety and frustration.

What Every Woman Needs to Get Schooled On.

When the American College of Financial Services recently quizzed retirement-aged people on the basics of how to make their money last, just 35 percent of men passed the test. As troubling as that is, only 18 percent of women passed.

A Divorce Settlement Mistake I Want All Women to Home in On.

Divorce at any age can be difficult. Even in the most amicable of situations there are major financial decisions to work through, and staying clear-eyed amid the emotional upheaval can be challenging.

This Girlfriend’s Money Guide to Steering Clear of Divorce

A recent Experian survey reports that more than one-third of people who divorced says it caused them financial ruin. And more than 60 percent of people surveyed said that money issues played a central role in the break up.

I Always Knew It: Study Proves Women Better Investors Than Men

Ladies, the jig is up. You can moan all you want about how you’re not “good” at investing, or it’s too confusing. I’ve long told you those are just excuses you have talked yourself into, yet that have no logical basis.

How to Wring More From Your 401(K)

You may have heard or read recently about some high profile retirement plan sponsors being sued by plan participants for high fees in the plan. Financial service firms-yep, folks who run mutual funds-have been hit with lawsuits, as have the plans run by MIT, NYU and Yale.

CONSUMER WARNING: CNN/SUZE ORMAN email Hoax

My dear Friends, If you receive an email that talks about me on CNN quoting something like “Brexit is Destroying the American Economy”, Please DELETE it. This is an internet scam from something they are calling Global Payday System. They are trying to steal your money. I Do NOT endorse this business. Please beware and report this as SPAM if you receive it.

My House Rules for Boomerang Kids.

More adult children are living with family than at any time in the past 60 years. Whether your twenty-something bundle of joy is back home (or never left!) because you’re a better roommate with better digs, or because they have yet to find a career job, you still need to lay down some financial expectations:

Teach Your Children Well-Part 1: Bill Pay Together

Sitting down with your children once a month and having them help you pay the family bills is an incredibly valuable life-lesson opportunity that sadly few families use.

A Retirement Planning Must for Women

You know I have long recommended that every household look into obtaining long-term care insurance (LTCi). Given our increasingly long life spans and the fast rising cost of health care, an LTCi policy can be the linchpin of a secure retirement. And it is doubly important for women to consider. According to the Society of Actuaries, a woman alive at age 65 has a one-in-three chance of still being alive at age 90. And if that 65-year-old woman happens to be in very good health the odds of being alive at 90 rise to more than 40%. In other words, there’s a good chance you could live a very long life.

A Message for Husbands: Your Wife Should Drive the Retirement Planning

One of the most common things I hear from many couples is that the husband likes investing and planning, and thus wives are all too happy to let him handle the retirement strategizing. Big mistake. Not because I am doubting the skill and intentions of men. Rather, my concern is that it’s women who typically are the most at risk in terms of retirement security for a very simple fact: Women tend to outlive men.

Same-Sex Marriage Ban Ends in Florida

Last night KT and I were lucky enough to get to go to the courthouse in Del Ray Fla to participate in the first gay marriage ceremonies. Read my thoughts on this historic day.